A Free Lunch

“Here is part of the tradeoff with diversification. You must be diversified enough to survive bad times or bad luck so that skill and good process can have the chance to pay off over the long term.”

—Joel Greenblatt

As I write this month’s cover letter, the summer season is about to kick off with all of its anticipation of a bit of a slowdown to the crazy pace of daily life, an anticipation that is often thwarted by events. For example, maybe you have, as do I, children or grandchildren competing in end-of-season sports tournaments and/or graduating from high school or college. It sometimes feels in the early summer like a gauntlet of rite-of-passage events that are emotional and overwhelming in the moment but also happen in a flash and then are over forever, hopefully leaving treasured memories.

I mention the above as I am reflecting on the state of the financial markets, the economy and companies’ prospects for earnings growth in the future. As my colleague, Fred Snitzer, wrote last month in Equanimity and Equities in regards to the past two years: “During this 730-day period the 500 largest and most successful companies in the richest country in the world have returned essentially zero.” As Fred also alluded to, that two-year ride – that basically went nowhere – was a very bumpy and uncomfortable ride of ups and downs. We understand that investors who have endured this period and yet have not been rewarded with growth in their portfolios may feel a little frustrated.

However, a few disappointing years do not make a trend and, even if they did, PMA continues to believe in the power of prudent diversification and risk control that is such an integral part of the ethos and process at our firm.

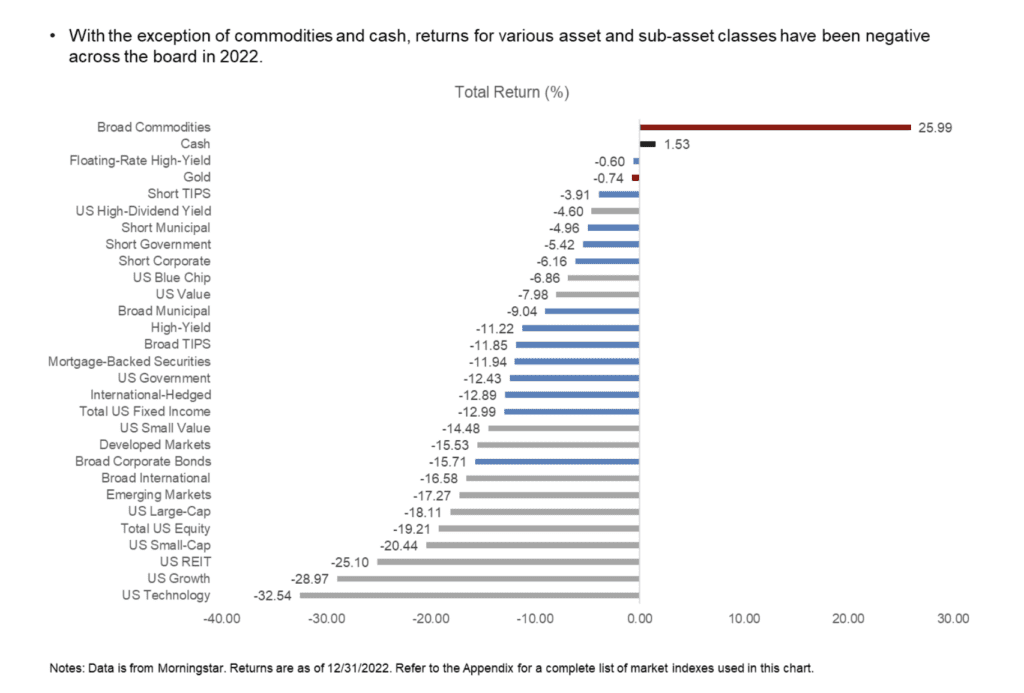

For example, consider the chart below which shows the performance of various asset classes for 2022, which we all will recall as being a difficult year. As you will see, all of the listed asset classes were negative for the year except commodities and cash:

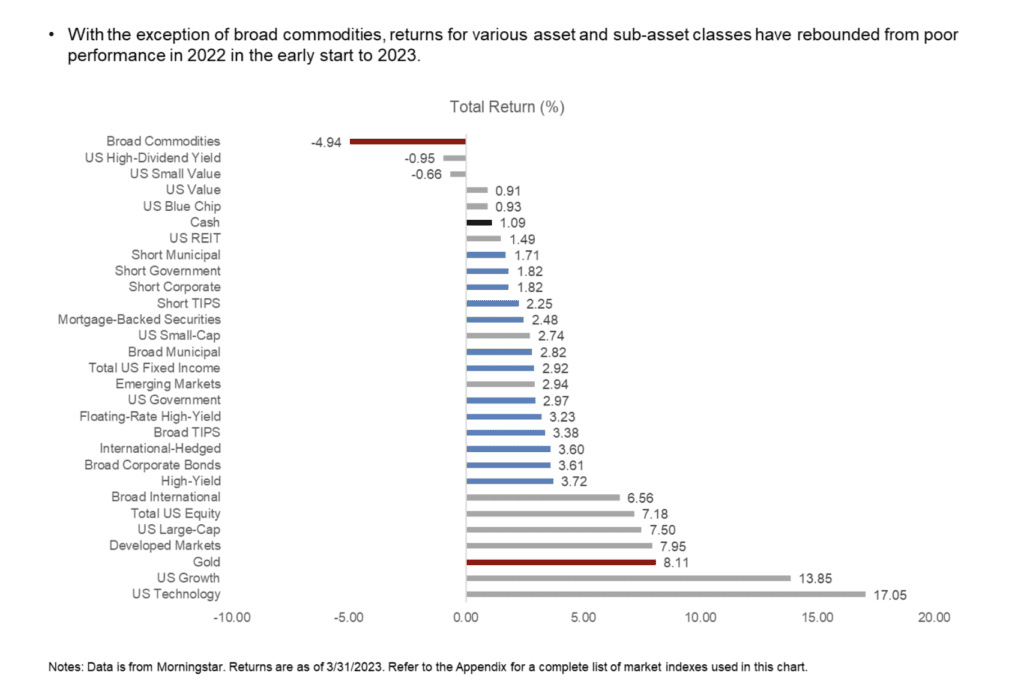

Now see the following chart for the same asset classes in the first quarter of 2023. It is almost a miror image of 2022. If an investor had decided to throw in the towel and get out of the market at the end of 2022, they would have missed a fairly attractive rebound in the first three months of this year. It is often said that “timing is everything.” That may be true, but it is also true that it is almost impossible to have consistent good timing when it comes to investing.

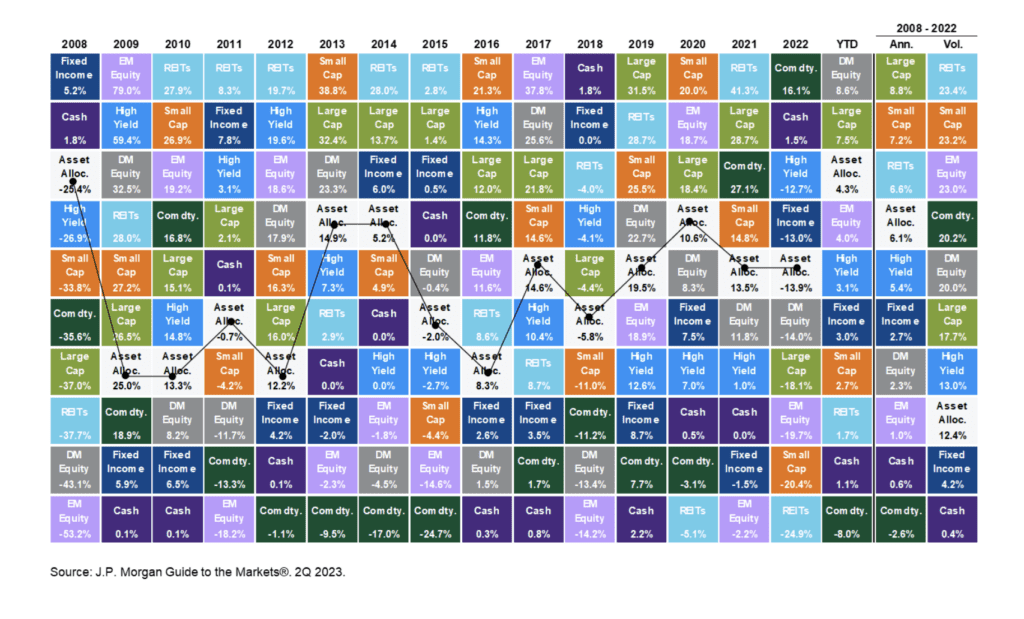

For the longer time period of fifteen years shown in the chart below, asset class returns are ranked year-by-year from highest to lowest from 2008 through March 31st of 2023. It’s telling that the returns for various asset classes are random and highly volatile with one year’s top performer often being one of the next year’s worst. There is simply no way to predict which asset classes will do well or poorly in the future. However, what is noticeable is that a “balanced portfolio” (labeled Asset Allocation in the chart) stays mostly in the middle of the chart and is much less volatile on an annualized basis over the entire period from 2008-2022. In fact, the Asset Allocation portfolio is the fourth best in returns over this fifteen-year period while also being the third least volatile.1 The “Asset Allocation” portfolio assumes the following weights: 25% in the S&P 500, 10% in the Russell 2000, 15% in the MSCI EAFE, 5% in the MSCI EME, 25% in the Bloomberg US Aggregate, 5% in the Bloomberg 1-3m Treasury, 5% in the Bloomberg Global High Yield Index, 5% in the Bloomberg Commodity Index and 5% in the NAREIT Equity REIT Index. Balanced portfolio assumes annual rebalancing.

As David Booth states in his article The Stock Market vs. Stocks in the Market, which is included in this month’s readings: “In investing, diversification is the closest thing any of us can have to a free lunch.” PMA makes every effort to strategically construct portfolios that are, as Joel Greenblatt put it above, “diversified enough to survive bad times or bad luck so that skill and good process can have the chance to pay off over the long term.”

This leads me back to my introductory paragraph. Even with a diversified portfolio, sometimes being an investor can be an unsettling experience, not unlike the end of an academic year or holiday season gauntlet of events which, in the moment, can feel overwhelming but, when looked back upon, we are very grateful to have participated in.

As my son’s coach has been preaching to his team all season, “be where your feet are.” Meaning, focus on what’s around you at the present and worry about what you can control. Ignore the noise and purposeful distraction of the headline writers and TV pundits. Enjoy the summer season and some rest and relaxation with family and friends. We appreciate your continued trust in our stewardship of your financial assets.