Bond Yields are Back!

It has been some time, but bond yields—the return to an investor from a bond’s interest payments—are back, and that’s a good thing for investors. To be sure, getting to this point was painful. With the Fed raising rates at the fastest clip since the 1980s, fixed income allocations from short-maturity to long-maturity, government to corporate, all experienced losses last year. But the end result of where we are today is a higher prevailing level of interest rates, and that suggests a better forward-looking return for those who hold fixed income in their portfolios.

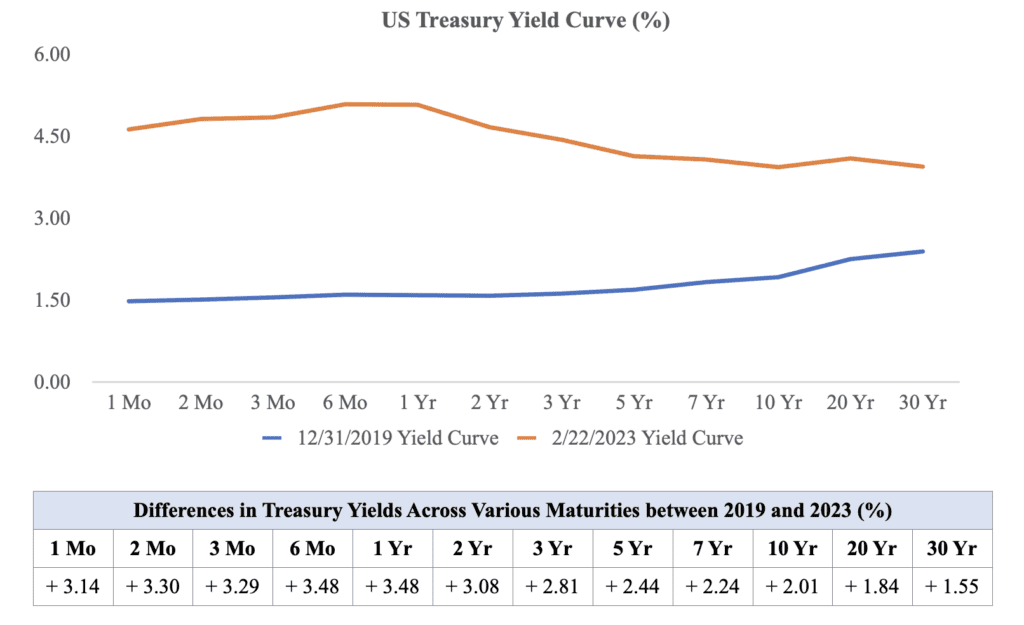

Refer to the first figure below, which highlights the stark differences in the US Treasury yield curve when comparing values from today (as I draft this memo on February 23, 2023) with those from the pre-pandemic era (December 31, 2019). The table below the figure summarizes the differences across each maturity category between the two time periods. As a quick refresher, interest rates across Treasury securities of various maturities form a “term-structure” (yield curve) of interest rates, typically ranging from 1 month to 30 years. Often, the curve is upward sloping, as longer-maturity bonds offer higher yields than shorter-maturity bonds. Longer-maturity bonds typically must provide higher yields to compensate investors for the greater risk inherent in lending their money for longer periods of time. Though the Federal Reserve can influence interest rates along the yield curve, there are a wide variety of factors that affect such rates. For example, the future outlook for economic growth and inflation are two common variables that impact the longer end of the yield curve more significantly.

Setting aside the odd shape1 The US yield curve is inverted at present, meaning shorter-term yields are higher than longer-term yields. Historically, an inverted yield curve has been associated with a recession about 12 months into future. of the yield curve today, it is clear how much higher rates are now relative to the end of 2019. The 10-year Treasury yield is 2% higher, and some shorter-maturity yields are almost 3.5% higher. That’s an astounding increase in a fairly short period of time. Importantly, not shown in the figure is that it’s been roughly 15 years since we’ve seen Treasury yields at current levels.

Source: US Department of the Treasury

Source: US Department of the Treasury

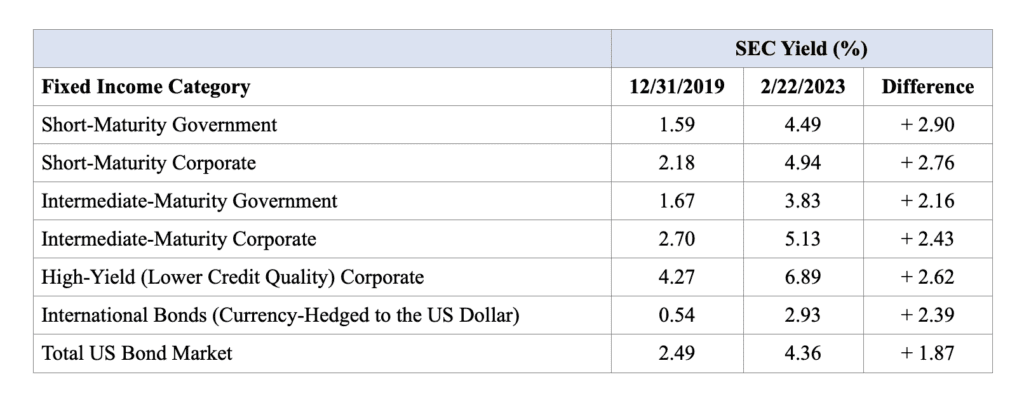

The data above is specific to Treasury securities, but PMA invests in fixed income primarily through well-diversified mutual funds that hold different types of bonds. Using a blend of funds allows our Investment Committee to effectively target particular exposures that we believe are appropriate for our clients given our longer-term focus while also factoring the current investment climate into our strategy.

The next table shows how much yields have changed for key categories of fixed income instruments held in the mutual funds that PMA invests in. Note that across the board, most areas of the fixed income market are now yielding markedly more. For some of the categories below, yields have more than doubled from pre-pandemic levels. And the total US bond market itself is now yielding almost 2% more than it was at the end of 2019.

But ultimately for investors, all of the above matters because the starting yield of a bond or bond fund is a good predictor of its forward-looking return. This is namely true because the majority of a bond’s total return (income return plus capital appreciation) stems from coupon income and reinvested coupon income. Equities, on the other hand, derive the majority of their total return from price appreciation rather than from dividend income.

But ultimately for investors, all of the above matters because the starting yield of a bond or bond fund is a good predictor of its forward-looking return. This is namely true because the majority of a bond’s total return (income return plus capital appreciation) stems from coupon income and reinvested coupon income. Equities, on the other hand, derive the majority of their total return from price appreciation rather than from dividend income.

We know that our clients endured a challenging year throughout 2022 given the simultaneous drawdown in both stocks and bonds. While we know it’s difficult to immediately shift focus to the future, and while we are certain that there will be further challenges ahead in the markets, we are more optimistic about the return prospects for our clients’ fixed income allocations moving forward—it’s easy for us to take this position because yields are materially higher.

With that said, the high degree of uncertainty that pervaded markets last year is likely to continue through 2023. As always, we will also continue to keep our eye on the macroeconomic landscape and make any modest adjustments to our clients’ portfolios that we feel are necessary. If you would like to discuss your specific fixed income allocation in greater detail, please do not hesitate to reach out to your advisor.