Cash in Context

Prudent Management Associates held its first client luncheon since 2018 on October 25th and we welcomed the opportunity to see so many friends and clients in person again. In the midst of so much political uncertainty and human tragedy, both here and around the globe, our guest Larry Siegel – whose views were skillfully drawn out by our interviewer, Ted Aronson – provided a bracing and reassuring antidote to today’s news with his qualified optimism about the future.

Larry’s message is, primarily, about the future, not the present. His book – Fewer, Richer, Greener – makes a compelling case that life on earth should improve over the next 100 years or so, as the combination of declining birth rates, greater wealth and productivity, and a cleaner earth (thanks to better technology) will extend the enormous progress in living conditions that the world has seen since the dawn of the industrial revolution. There will be fewer of us, we will be richer, and the world will be greener.

This is great news, assuming it turns out to be true. Optimism and hopefulness about the future are very American traits, and they are as ingrained in the philosophy of PMA as they are in many American citizens across the country.

However, as we have said ad nauseum, we live in the present. The performance of the financial markets during 2022 is fresh in our memory. Stocks fell in value and bonds had historically bad returns in 2022. Furthermore, what do we see when we look around the world today? Political instability, economic uncertainty, war, savagery, a poisonous social media, and – in less than a year – a presidential election the thought of which is making many people depressed. It is understandable why so many feel jittery when considering the recent past, the present, and the near future.

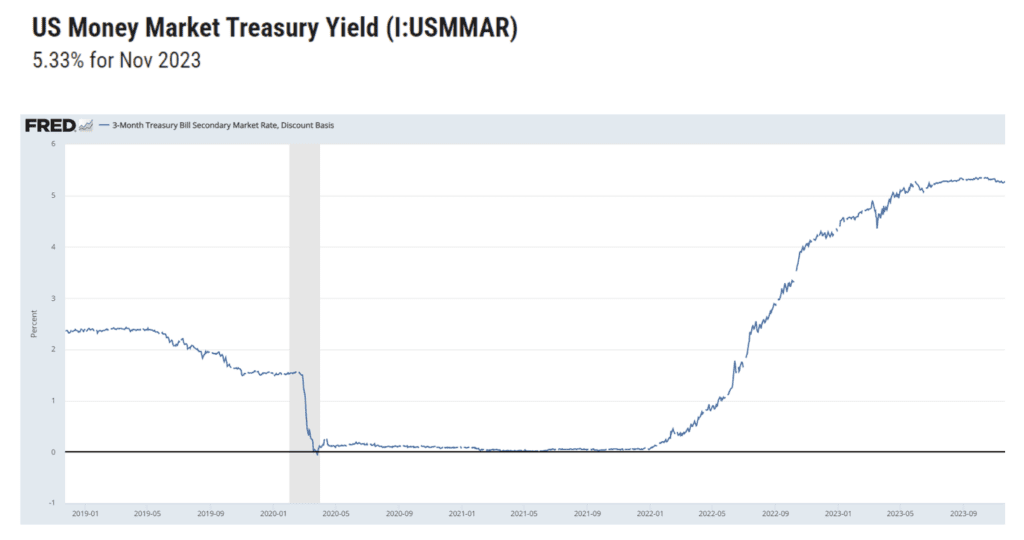

In the midst of all this nervousness, cash is getting a lot of attention as an asset class. Consider two well-known and contradictory phrases about cash: “Cash is King” and “Cash is Trash”. Right now, in many investor’s eyes, cash is unquestionably king. So regal is cash right now that investors have poured $5.7 trillion into money market funds, an all-time record. Given that in 2022 the S&P 500 was down -18%, the broad bond market was down -13%, and 3-month treasury bills (a good proxy for cash) were up +2%; and when you see that during 2023 cash is on track to earn close to 5%, whereas the broad bond market is only up 2.5% – well, it’s not hard to understand this flood of money into cash.

Who wouldn’t want to invest in a riskless asset when you see graphs like this, produced by FRED (Federal Reserve Economic Data), the (well named) service offered by the St. Louis Federal Reserve. This chart illustrates the sharp rise in yields for U.S. government 3-month treasury bills (again, a good proxy for cash) from the period 2019 through the present.

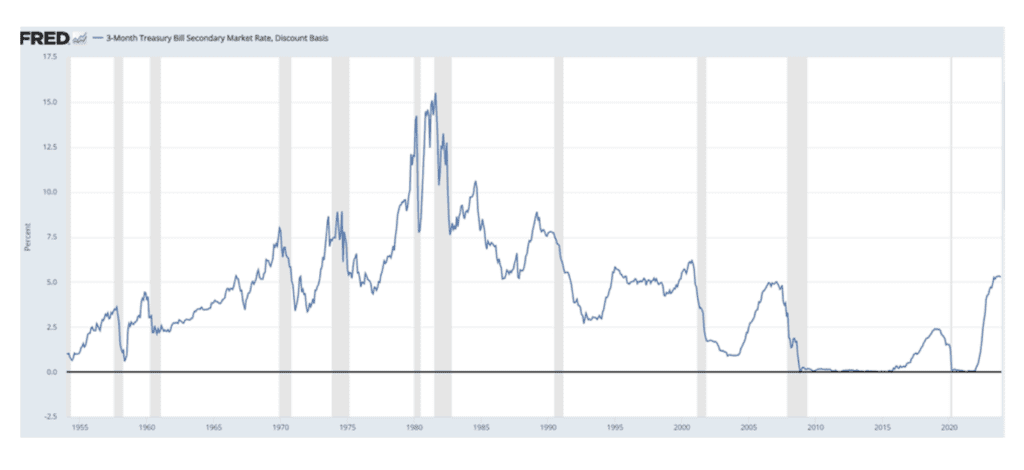

This looks great, but 2019 through the present is a short period of time. Context is needed; it often pays to take a longer-term view of things. Let’s extend this same chart back to 1955:

Looking at these yields over a longer period of time clearly illustrates that the yields on cash can fall as steeply as they rise, which suggests that cash may be king now, but it could be trash very soon, particularly if the Fed starts cutting interest rates more quickly than expected.

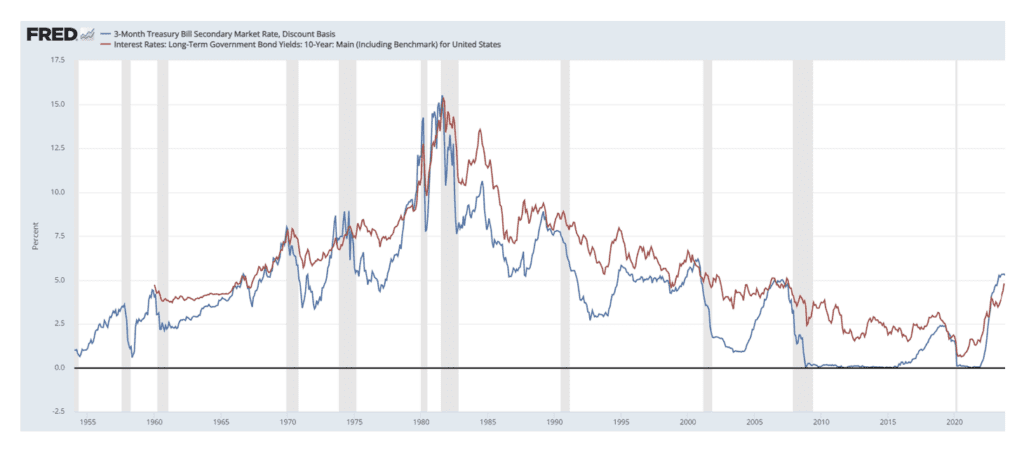

In addition to taking a longer view, let’s add some more context by comparing the yields on the three-month treasury bill to the yields of a 10-year treasury bond over the same 68-year period of time. The red line on the chart below represents the yield of the 10-year bond and the blue line is the yield of the 3-month treasury bill. You can see that more often than not, you get paid more for taking more risk (the red line is above the blue line). Yes, there are times, such as now, when short-term cash actually pays more than the 10-year treasury (the blue line is above the red line). However, this phenomena of getting paid more for taking less risk is infrequent and temporary, and usually occurs right before a recession.

All of this is to say that the current attractiveness of cash relative to other fixed income investments is a rare event, difficult to time, and does not last very long when it does occur.

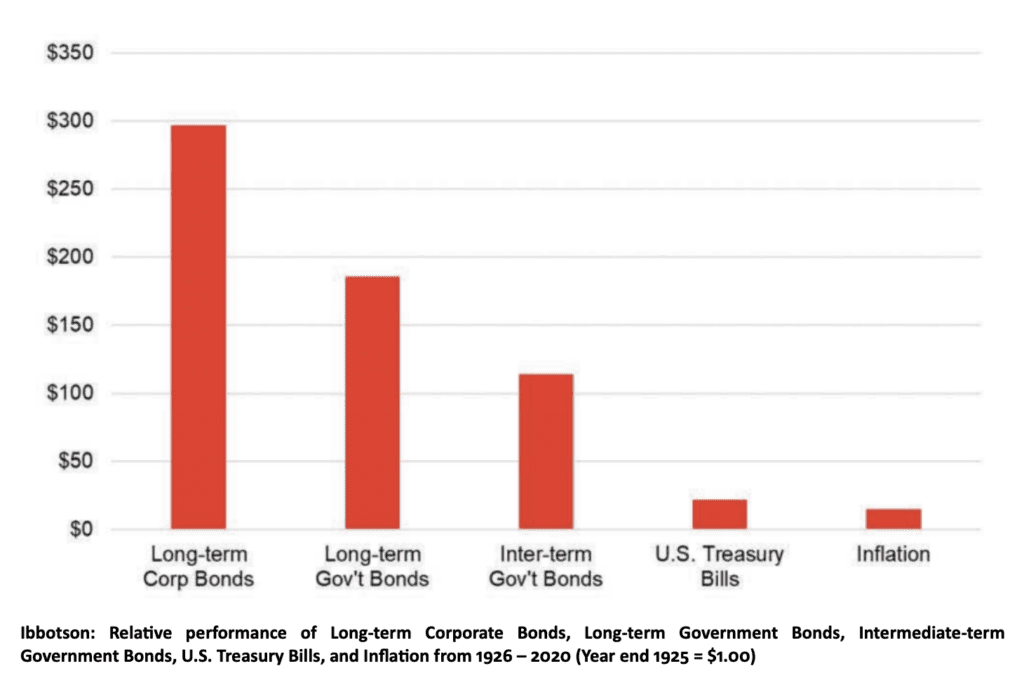

Here is another graph showing the growth of $1 from 1926 through 2020 for various sectors of the bond market. $1 invested in a U.S. Treasury Bill grew to about $25 over this 94-year period, far below Intermediate-Term Government Bonds, Long-Term Government Bonds, and Long-term Corporate Bonds.

It feels great to hold cash right now and the purpose of this letter is not to pressure anyone into reducing their allocation to cash. Rather, it’s to encourage us to think about how cash has performed as an investment vehicle over the long-term when compared to bonds, what cash is for and what is an appropriate amount to hold?

There is no one answer to these questions and it depends on each person’s unique set of circumstances and temperament. Various rules of thumb are bandied about in the industry. Some say you should have six-months of living expenses in cash, others say one-year, and others say two-years. Others say the amount of cash you hold should depend on what stage of life you are in (with older retirees having a larger amount in cash). In addition, cash is good for unexpected emergencies and near-term, one-time expenses (car purchase, tuition payment, wedding, etc.)

The point really is to say that you should pick a cash position you are comfortable with and stick with it, rather than trying to time when cash is king and when it is trash, while remembering these key points:

- Compared to all other asset classes, cash usually returns the least amount over most time periods.

- In periods where cash does outperform other fixed income assets, the period of time is brief and can change rapidly, as the yields can quickly revert to their more typical relationship (longer-term bonds outperform cash).

- As with all investing, don’t try to time your allocation to cash.

- Pick a cash reserve amount that you are comfortable with and stick with it, whether that is 6-months of expenses, 12-months, 2 years, etc.

- Lastly, with all of the uncertainty I described above, if you find that you sleep better at night with a larger allocation to cash these days, you might be better off taking less equity market risk instead. This is an asset allocation question that PMA’s team can most certainly help you think through.