Current Markets

The first eight months of 2024 have been filled with substantial macroeconomic uncertainty. This uncertainty, largely driven by economy wide factors, naturally leads to questions relating to its implications for the behavior of stock and bond prices. Should investors change their investment portfolios in response to this environment?

Two important sources of this uncertainty were discussed in recent issues of Partner Talk. Last month, Dan Berkowitz addressed complications arising for the Federal Reserve as a result of its dual mandate. The Fed is mandated to promote both stable prices and maximum employment. As Dan noted, the two mandates can push in opposite directions. Increasing the Fed funds target rate will help to stabilize prices since the resulting higher interest rates will reduce inflation pressure. But increasing the Fed funds target rate will also put downward pressure on economic activity and this potentially leads to lower employment.

In June, Fred Snitzer addressed the question “Should I make any changes to my portfolio before the election?” Fred’s review of historical evidence indicated that there is not any conclusive evidence that either party is better for future market performance. This lack of conclusive evidence suggests that the best action to take as the election nears is to not make portfolio adjustments only because of the election. Predicting future market performance is extremely difficult at best.

Since the economic environment does change quickly, in this edition of Partner Talk we will again visit these important issues.

On the inflation front there is good news and finally the Fed has signaled that a rate cut is likely in September. In August, Jerome Powell, the chairman of the Federal Reserve, stated at a widely watched speech from Jackson Hole, Wyoming, that “the time has come for policy to adjust” — referring to the need to change the policy followed over the last year which left the fed funds rate unchanged. The recent decline in the rate of increase of the PCE1Personal Consumption Expenditures Price Index, the measure most closely followed by the Fed, triggered the Fed’s change in policy. The most recent reading as of the end of July, looking back one year, indicated an annual inflation rate of 2.5 percent. Looking back three months, the annual inflation rate is substantially lower at 1.2 percent. After much hesitation, it does seem that the Fed’s members now do feel that the two percent inflation target will be achieved. There is wide agreement that a rate cut will be made at the next meeting held on September 17/18. The consensus is that a 25-basis point cut is most likely but a more aggressive 50 basis point cut is also possible.

The second mandate of the Fed is to achieve maximum employment. Given recent employment reports, there are concerns on that front. The unemployment rate has been slowly increasing over the past year. The April 2023 reading was 3.4 percent. That rate increased to 4.3 percent this past month. However, given that the Fed is comfortable with the price stability mandate, the proposed rate cut also is intended to boost economic activity and thus reduce the unemployment rate.

When evaluating these mandates, economic growth and reasonable corporate earnings are important considerations for the Fed. The economy has been surprisingly sturdy. Economic growth as measured by GDP increased at an annual real rate of 3.0 percent for the second quarter of this year. Looking forward, growth is expected to moderate but still to remain at a reasonable annual rate of 2 percent.

Corporate earnings are also expected to be solid. In aggregate, earnings are expected to increase by 10.1 percent in calendar year 2024 relative to 2023, and by 15.3 percent in calendar year 2025 relative to 2024. (These estimates are based on the analysis of FactSet.) If these high levels of growth are realized, it should justify current market values and the proposed Fed action.

The second source of uncertainty is the upcoming election. At this time, the two candidates are basically tied in the polls. Two of many questions are 1) whether there is a candidate that dominates from the perspective of future economic activity and 2) should investment portfolios be adjusted in anticipation of the election results. As argued in the June issue of Partner Talk, based on historical data, there are no clear answers. However, one can ask from an economic perspective, what difference between the candidates might be important?

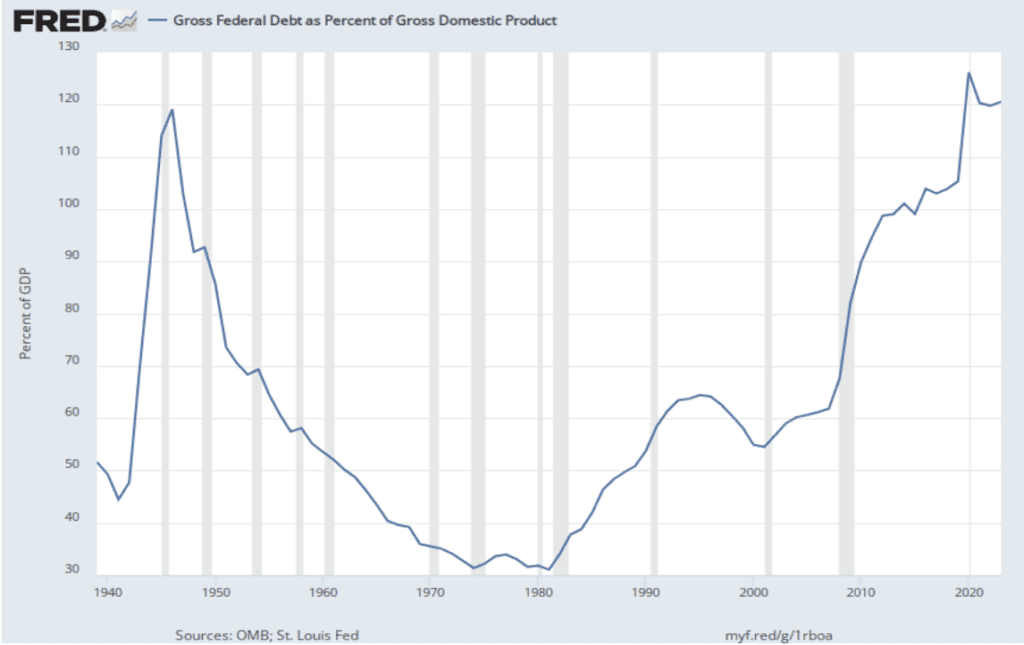

One answer to this question is that the candidate that can have the greatest impact on deficit reduction would be best for the economy. The current problem is that the federal debt is very high relative to GDP and on an increasing trend. This trend is evident in the graph below which plots gross federal debt as a percent of gross domestic product from 1940 through 2023.

The ratio spiked to about 125 percent in 2020 and has remained high since then. The ratio is likely to continue to be high and the deficit is likely to continue to increase. The 2020 debt spike can be attributed to the pandemic but not the continuing high level. Over the time period from 1940 to 2023, the only time the debt as a percent of GDP was as high as the current value is in the middle 1940’s. In that case, the high level of debt was due to wartime needs.

Unfortunately, this concern related to a growing deficit does not provide much guidance relating to which candidate is preferred. Given the current political debate, in which no candidate is aggressively advocating for material spending cuts, it is a safe bet that the deficit will increase no matter who wins.

To summarize, the economy is currently on a positive trajectory and the uncertainty driven by the macro environment seems relatively low. Year-to-date market returns are generally positive with the S&P 500 stock index up over 19 percent through August and the Bloomberg Barclays Aggregate bond index up more than 3 percent. Given this, one-time portfolio adjustments are not necessary. However, it should be emphasized that this conclusion does not imply that careful monitoring of one’s portfolio is not essential. At PMA we recognize that economic conditions can change very quickly and often will necessitate portfolio adjustments. One clear concern at this time is that current geopolitical considerations may impact economic growth and change underlying risks. Such an outcome would require an assessment of the appropriateness of one’s portfolio positioning.