Market Corrections: A Normal (but Unpleasant) Part of Investing

“You need to know the market’s going to go down sometimes. If you’re not ready for that, you shouldn’t own stocks. And it’s good when it happens.”

—Peter Lynch

The first five months of 2022 have been difficult for the financial markets, with the S&P 500 returning -12.76% and the Bloomberg US Aggregate bond index -8.92% through the end of May. As disconcerting as this may be in the moment, it is a relatively short segment of time over a long-term investor’s time horizon and really should be viewed more as a distraction along the way to one’s planned destination.

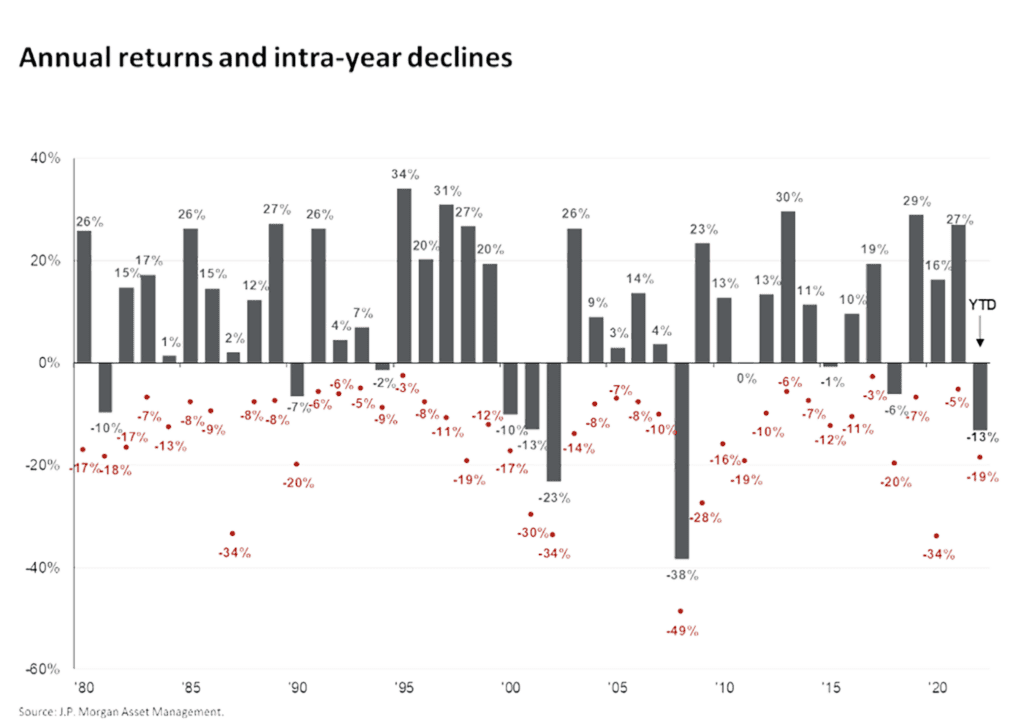

To illustrate this point and the volatile nature of financial markets, consider the intra-year stock market declines over the period from 1980 through May 31, 2022. As you can see in the chart below, despite average intra-year drops of 14.0%, annual returns were positive in 32 of 42 years, or 76% of the time. (Source: J.P. Morgan Asset Mgmt.)

Each of the 32 positive years had intra-year negative returns, which shows that staying invested for the long-term is key to having a positive investment experience. Timing the market has been proven over and over to be a losing proposition.

Another example of why focusing on the long-term is important comes from a recent letter written to clients by David Booth, Executive Chairman and Founder of one of our fund companies, Dimensional Fund Advisors. He asks the reader to imagine that it’s 25 years ago, 1997, and, if you knew the following events would happen over the next 25 years, would you invest in the stock market and stay invested throughout this 25-year period without trying to time the market?

- Asian Contagion

- Russian Default

- Tech Collapse

- 9/11

- Stocks’ “lost decade”

- Great Recession

- Global Pandemic

- Second Russian Default

Again, he asks the reader, “what would you have done if you knew all of those events would take place over the next 25 years? Would you have invested at all or been able to stay invested?”

Here’s what happened during this time period. From January of 1997 to December of 2021, the S&P 500 returned, on average, 9.8% per year! (Source: Dimensional Fund Advisors)

And, it’s important to point out, these results are quite indicative of the experience of a long-term investor in stocks. The average return of the S&P 500 from 1926-2021 is 10.5%, despite all of the negative events that occurred over that 95-year period. (Source: AJO Vista)

The point is, as the old saying goes, don’t lose the forest for the trees. If you, as we hope and believe all PMA clients do, have a realistic financial and investment plan to meet your long-term goals and a prudent, time-tested asset allocation and manager selection process to carry-out that plan then you should stick to the plan rather than deviating from it when the inevitable market corrections occur.

Farmers, in the days before GPS navigation systems and other technology were available, would find a tree on the horizon to aim for when they were plowing and planting so that they would be able to plant in a straight line and not be distracted by objects along the way that would distort their direction and cause them to go astray.

Like those farmers, PMA clients should stick to the financial and investment plans we have developed together and do their best to ignore all the distractions along the way. In the meantime, we are continually monitoring the economy and the markets and making any needed adjustments to the allocation of our clients’ portfolios and the managers that we use to carry out our investment philosophy.

Currently, we are focused on the fact that inflation is at its highest level in 40 years and the Fed is in the process of raising interest rates at the most aggressive pace since the 1980s. Increases in the Fed funds target rate are expected for the remainder of the year and quantitative easing will likely end. The Fed’s expectation is that, with these actions, inflation can be reduced without slowing the economy. But, such a result is far from assured.

Overall economic growth is definitely slowing and current earnings growth is being depressed, to some extent, by economic forces including supply chain issues, labor supply shortages, and higher inflation related costs. While the uncertainty of all of these variables will likely add to market volatility in the short-term, resulting market corrections also allows fund managers to buy equities at lower prices and, when the market rebounds, should improve their relative performance over the long-run.

Since PMA was founded forty years ago, we have worked hard to protect our clients’ assets in bad markets and deliver very respectable performance in good markets. This was not by accident. It was by design. The key to accomplishing this, beyond all of the academic theory and research and years of capital markets experience that goes into the asset allocation construction of our portfolios and our mutual fund analysis, is the ability to continue to steer the ship on the same course despite the fears that come with economic, political, societal and health uncertainty and the resulting market plunges. To not make rash, emotional, decisions to change course when the going gets tough is much easier said than done. But, that’s what we’ve counseled and what we’ve practiced. We appreciate your continued trust in our stewardship of your assets.