Putting the Election into Context

In the lead-up to the presidential election, we spoke with many clients who expressed concern about how the stock market would react to a contested election with no immediate clear winner. In the context of 2020, a year like no other, premonitions of instability were inevitable. Many clients were nervous. Truth be told, we were nervous.

To those clients with whom we spoke, we said that the market was already anticipating a contested election and might shrug off an inconclusive outcome, as long as the outcome was eventually resolved. Furthermore, in the days leading up to the election, the market actually rose; the financial press was full of stories about how the market, following the polls, was anticipating a “blue wave”, which would mean trillions of dollars in government spending to help ease the burden of the continuing coronavirus.

What has happened so far? We do as of this writing have a contested election in that President Trump has not conceded and is initiating litigation (although at this juncture the odds look much more favorable for Joe Biden). However, the blue wave did not materialize and the S&P 500 still rose 6% between Tuesday, November 3rd and Thursday, November 5th. Why? Well, now the financial press is full of stories about how the market rose because it is relieved to have divided government, not really ever wanting a blue wave in the first place.

It’s easy to poke fun at the financial press, but the point is that it is very difficult to predict how the market – a constellation of millions of human beings and an increasingly large number of algorithmically programmed computers – is going to react to unusual and unprecedented events. Although we are buoyed by the markets’ reaction so far, and we hope it continues, we think we are still too early in this story to become complacent, and we caution that we still may see some volatile days in the near future.

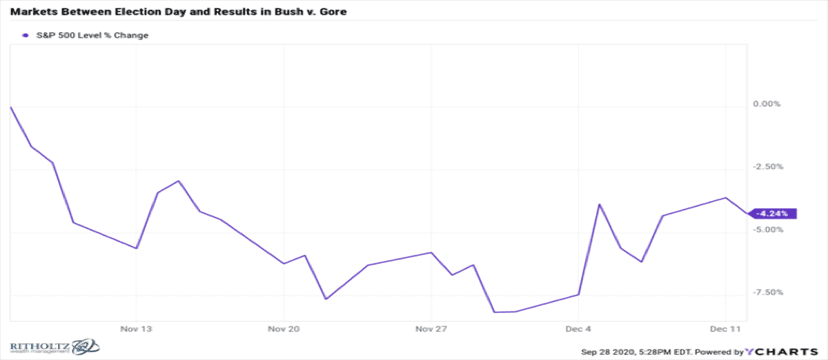

Sometimes the past can offer us lessons to assuage our concerns. What does the last contested election tell us, if anything? This chart from Ritholtz Wealth Management shows the percentage performance of the S&P 500 during the contested election of Bush-Gore in 2000 from election day to the Supreme Court decision on December 12, during which the market was down – 4.24%.

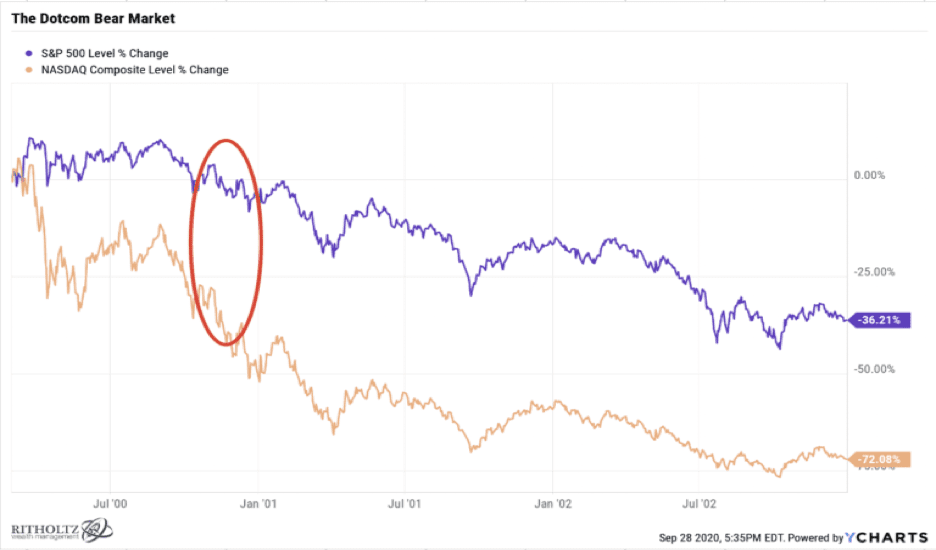

A 4% drop is not pleasant, but in the context of the larger picture – the bursting of the tech bubble and the attacks of September 11 – this 4% drop barely registers:

On the other hand, a perfectly reasonable reaction to these facts is: so what? What does this have to do with today? The America of 2020 is not the America of 2000.

So, historical comparisons have their limitations. The past can only help so much. And we live in the short-term, where current events can take on an importance that, in hindsight, is often not warranted.

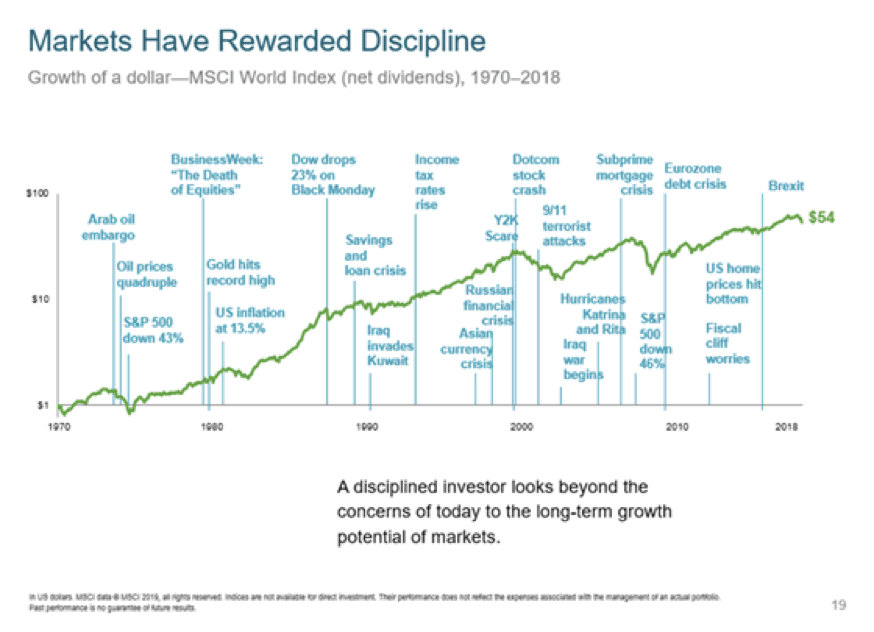

But if history provides few guides for the present situation, it still can provide perspective. This chart from Dimensional Fund Advisors illustrates the idea that over the long-term, markets have rewarded the disciplined investor who is able to weather the inevitable short-term fluctuations in the stock market. Historically over the long-term markets go up, but during the short-term there can be significant volatility and times when the market delivers painful setbacks. The disciplined investor also learns to live with another important idea: sometimes the short-term is not that short. There can be three, five, even ten-year periods where the market delivers nothing. This is the price you pay for reaping the rewards of being a long-term investor.

It would be foolish to downplay the deep divisions that cleave America, divisions that will not miraculously heal when this election is over. But at least the history of this country suggests, even if it does not promise, that the economy will continue to grow, despite the recurring problems, through wars, recessions, political division, and more, driven forward by the talent and relentless energy of its people. As investors, we should expect more volatility but also more growth, and we should try to consciously develop the patience and fortitude to handle this volatility, often over long periods of time.

Finally, we also thought it would be helpful to provide a brief update on our last quarterly Investment Committee meeting which we held in October. We reviewed the state of key macroeconomic and financial variables including inflation, unemployment, and corporate earnings. We also discussed the current performance disparity between the “value” and “growth” investment styles, and more specifically, whether any changes to our portfolios’ positioning was necessary. The Committee ultimately decided to stand pat.

If you are interested in learning more about any of the topics our Committee discussed, please do not hesitate to reach out to us.