The Election and the Markets

It was the best of times, it was the worst of times

— Charles Dickens

As the first half of the year comes to an end, it is appropriate to feel a range of contradictory emotions, as if we are living in a contemporary Dickens’ novel. On the one hand, the economy appears strong – with healthy consumer spending, strong corporate earnings, and declining inflation – and the markets optimistic – the S&P 500 is up 15% through the end of June. But in conversations with clients we have noticed an undeniable uneasiness with the wider world, and appropriately so. Who could not be concerned with the state of the world today? As we have said to some of you: “the economy is good, the world is a mess.”

Others in the investment world echo this sentiment. The title for JP Morgan’s 2024 Mid-Year Outlook is “A Strong Economy in a Fragile World”, the source of this fragility being – what else – the looming U.S. election and rising geopolitical risk.

Of these two risks, one of them – the election – is more of a certainty, relative to the wars in the Ukraine and the Middle East. True, this is not saying much, but at least with the election we know, for better or worse, when it will take place. It is not surprising that the preponderance of questions we receive from clients are about the election, and not about geopolitics, and usually come in three variations:

- “Which party, historically, has been better for the economy? It’s my party, right?”

- “Should I make any changes to my portfolio before the election?”

- “What should I do if that awful Republican/Democrat [you choose] actually wins?”

1. Let’s start with the first question – which party is better for the economy.

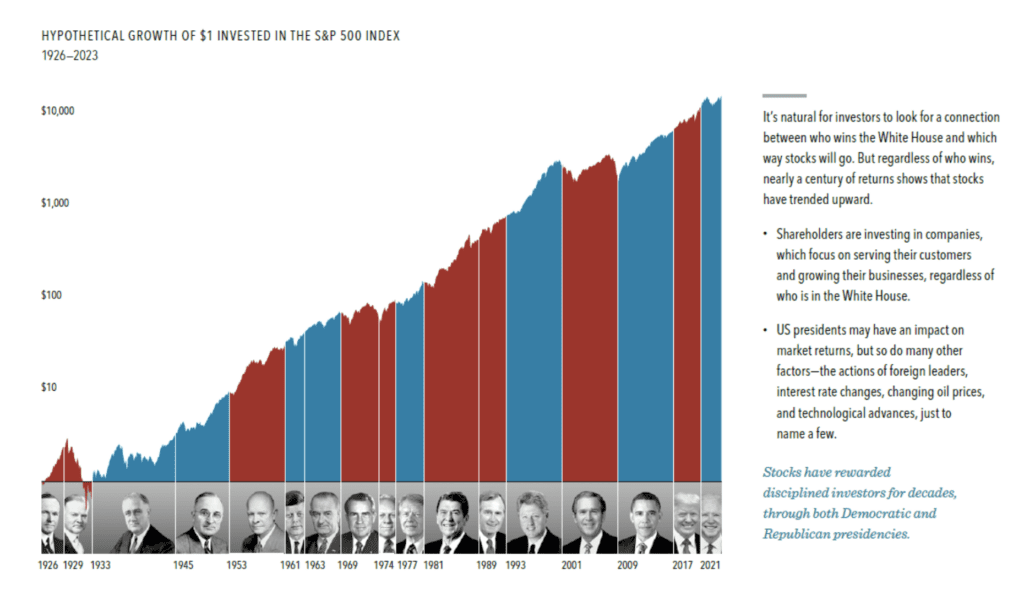

Between the years 1926 and 2023, Democrats held the Presidency for 51 of those years, during which the S&P 500 returned 14.8%. During the other 47 years, when there was a Republican President, the S&P 500 returned 9.3%.

So, that settles it, no? The debate is over. Every one of us should vote Democrat.

Of course, we know that the economy is not controlled by the President, as if he were a God. Congress plays a large role, as does the Federal Reserve, state legislatures, Federal agencies, the Supreme Court, and – probably most of all – everyday workers and entrepreneurs, whose productivity and technological innovations are – some would argue – the real drivers of the economy.

Statisticians love to point out “spurious correlations”, where one variable seems to cause another, but where a causal relationship is actually lacking. One of the most well-known examples is the correlation of ice cream sales to murder rates. Both seem to spike at the same time and for the same duration, as if eating more ice cream causes people to become more violent. The simple truth is that both spike during the summer, and the rise in one has nothing to do with causing the rise of the other.

It’s very hard to determine if a Democratic President caused the 5% premium in stock market returns, or if there was another variable.

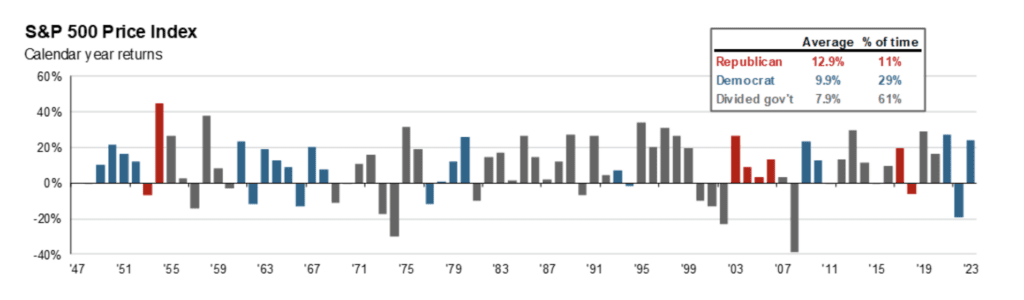

Here’s another way to look at the data:

This chart illustrates that from 1947 through 2023 the S&P 500 did the best when there was both a Republican President and Republican Congress.2 Does that settle things?

Not in the slightest. First, during this period of 76 years, Republicans were in total control for only 8.4 years, or 11% of the time. That’s a very small sample size. Second, should the crash of 2008 really be assigned to “Divided Gov’t” when Republicans were in charge from 2003 through 2006? And third, note that this chart started in 1947, and not 1926, thereby excluding Republican Herbert Hoover’s Presidency, which coincided with the Great Depression and an annualized return of -27.2%!

The world is complex. Data can be sliced and diced and twisted like a pretzel by smart political professionals, whose job is not to be nuanced or subtle but only to present their candidate and party in the best possible light.

So, our answer to the first question – “Which party, historically, has been better for the economy?” – is: it’s inconclusive, but, most importantly, both parties have presided over significant gains in the equity markets.

2. Let’s address the second question: “Should I make any changes to my portfolio during the months leading up to the election”?

Implicit in this question is the idea that the months preceding an election will be more volatile and therefore more risky, and a risk-averse investor should shift more of their assets to bonds or cash.

Here, the data is actually a little more conclusive. From a statistical perspective, volatility does increase during the lead up to an election. However, the increase in risk is not so great that a typical investor would notice it all that much, and it’s over a short period of time. Furthermore, during the four months leading up to presidential elections over the period 1926 to 2023 stocks still have a higher return than bonds, although with greater risk than usual.

Reducing your risk prior to an election is really just a variation on market timing, which is not a strategy we favor as discussed in many of our prior cover letters. So, our answer to this second question is an unqualified “NO”.

3. Finally, the third question, and the politically most sensitive one. What should you do if your candidate does not win?

First, let’s consider some numbers. From the time of Donald Trump’s election to election day of 2020, US large-cap equities returned 15.6% per year. And from Joe Biden’s election in 2020 through the writing of this letter, US large-cap equities have returned 12.4% per year.5

Also consider the performance of the S&P 500 during the time period of July 1, 2020 through April 30, 2022, a period plagued by riots, the pandemic, increased crime and violence, the election of 2020, the disgrace of January 6th, and the inauguration of Joe Biden. It was up 36.5% during this 20-month period. The point is that markets do (and should) go up independent of who is President.

Could it be different this time? Sure. This election is, to put it mildly, unusual. A protracted, inconclusive, drawn-out election, accompanied by demonstrations and riots, will no doubt spook the market. But we are operating on the assumption that this will be a short-term problem, and the uncertainty and volatility of even this election cycle will eventually be resolved.

The American Presidency is a powerful position, but it’s still only one person.

Look at the picture below. Think of each one of these Presidents as the beneficiary – not the cause – of a strong, wealthy country with a dynamic economy. To some extent, they ride the wave, just like the rest of us, but because they are the only nationally elected leader of this large country, they get all the credit or all the blame, when they really only deserve a portion of either.

So, our answer to the third question – “What should I do if my candidate does not win?”- NOTHING.

We hope you have a good summer and do not spend too much time thinking about the November election. When we enter the Fall, our advice is:

- Ignore political pundits who confidently declare which candidate will be better for the economy.

- Do not change your portfolio in the lead up of an election, simply because of an election.

- Do not change your portfolio after the election, regardless of who wins, simply because of the election.

- Pray for America, which we still believe is, in the words of Abraham Lincoln, the “last best hope of earth.”