The Halloween Effect

“People spend all this time trying to figure out “What time of the year should I make an investment? When should I invest?” And it’s such a waste of time. It’s so futile.”

– Peter Lynch

In June of 2018, I wrote a Partner Talk letter titled Sell in May and Go Away? It referenced the old Wall Street trading adage I learned in the mid-90s that came from the belief of some equity traders that if you sold your equity holdings in May, went away for the summer, and didn’t buy back equities until October, you would do better than if you had held all of your equities during this time period.

As I write this Partner Talk letter, excited trick-or-treaters wearing costumes of varying sophistication, ring our doorbell with the anticipation of securing handfuls of candy. This reminds me of another investment saying known as the “Halloween Effect” which suggests that stocks tend to perform better in the six-month period between November and April than they do in the other half of the year, from May to October, when it is better to sell and go away.

Before we give up on our long-term buy-and-hold investment philosophy, however, the “Halloween Effect” is really just another market-timing gimmick that academic theory and investing experience can easily poke holes in. Like all market-timing “strategies,” any patterns are usually the result of selection bias, where researchers inadvertently focus on patterns that support their hypothesis while ignoring contradicting evidence. Even if the pattern was real, it is likely unexploitable due to transaction costs and tax implications associated with frequent buying and selling of stocks. If only successful investing were that easy!

Our most recent Investment Committee meeting took place on October 18th, and our current thoughts about the economy and the financial markets follows. As we approach the end of 2023, the financial markets are grappling with a variety of economic challenges and geopolitical tensions and uncertainties. In the third quarter of 2023, market performance was negative across all equity asset categories and bond indices. The U.S. equity market, as measured by the S&P 500 Index, had a third-quarter return of -3.27%. The U.S. fixed income market, as measured by the Bloomberg Barclay US Aggregate Bond Index, declined 3.23%. But, on a year-to-date basis through 10/31/23, it has been a decent year with the S&P 500 Index up 10.69% and the Bloomberg Barclay US Aggregate Bond Index down 2.77%.

The negative return of the bond market is disappointing, as bonds continue to be under pressure from rising interest rates, with yields on government and corporate bonds inching higher. The Fed voted to increase the policy range by 25 basis points in July to the current target range of 5.25 – 5.50%. The Fed then paused rate increases at the September meeting and again at the November meeting. Despite this, bonds still perform an important role as a diversifying asset and source of protection in PMA portfolios.

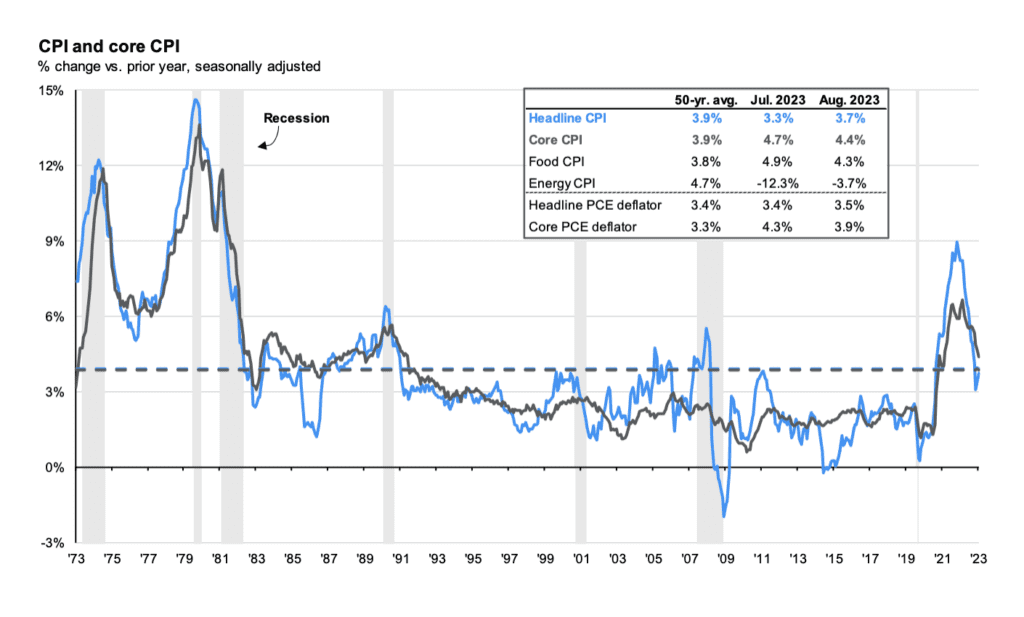

One of the key determinants of how the economy and, hence, the markets, will do going forward is inflation. Inflation is moving in the right direction–lower–but has proven to be more persistent than expected through the first half of the year. Looking back one year from the end of September, the annual inflation rate, as measured by the CPI, was 3.37%. This value is higher than the annual number reported last quarter. Focusing on the recent quarter, the CPI-based inflation measure is even higher at a value close to 5% on an annualized basis.

However, there are two reasons to conclude that the CPI reading overstates the relevant inflation facts. First, the Fed prefers to focus on the personal consumption expenditures (PCE) price index which excludes food and energy. Using this index, the annualized inflation rate over the last quarter is less than 2%. Second, a moderating view of inflation is being indicated by the bond market. Using the government bond market, looking forward the annual breakeven inflation rate is 2.34% for 10 years and 2.26% for 5 years. These breakeven numbers are much lower than backward-looking CPI readings. The biggest question looking forward is – can the Fed reduce inflation sufficiently without triggering a significant economic slowdown?

Source: J.P. Morgan Guide to the Markets®. 4Q 2023.

Source: J.P. Morgan Guide to the Markets®. 4Q 2023.

With positive growth projections for both GDP and corporate earnings going forward, there is a growing consensus that a hard landing for the economy accompanied by a recession can be avoided. However, if inflation continues to stay above the Fed’s target, the Fed may feel it is necessary to increase rates.

Geopolitical tensions have escalated, contributing to uncertainty and potential market volatility. Trade disputes, conflicts, and political instability can impact investor sentiment and disrupt global supply chains, affecting the performance of different asset classes. The financial markets are sensitive to these developments, which makes investing in an intelligently constructed and well-diversified portfolio, like the ones PMA has built for over 40 years, even more important.

It is important for investors to address these economic and geopolitical headwinds by having diversified portfolios and following a disciplined investment approach rather than trying to time the market based on seasonal patterns like the Halloween Effect. The key to this effort is the ability to continue to steer the ship on the same course despite the understandable fears that come with economic and geopolitical uncertainty. We appreciate your continued trust in our stewardship of your financial assets.