Why International? (Redux)

In September 2016, PMA’s late co-founder, Dr. Marshall Blume, wrote a memo about investing internationally titled “Why International?”. It is hard to believe that he wrote this note almost a decade ago. Presciently, and not surprisingly, much of the analysis from his original memo is still broadly applicable to our current investment climate. Dr. Blume summarized the current state of investing abroad in this paragraph:

Over the past several decades the cumulative return realized by US stocks has exceeded the cumulative return realized by international stocks. Yet, PMA, as well as other investment managers, still maintains investments in international stocks. Why? First, in investing, the long-run is a series of short-runs, and random events in the short-run can produce big differences in final outcomes. Although US stocks have sometimes outperformed international stocks, the opposite easily could have occurred. Second and more importantly, international stocks deliver significant benefits from diversification.

I agree with Dr. Blume’s analysis, and I find it helpful to think about the case for international investing in two ways: from both a risk diversification perspective and from a return diversification perspective.

By risk diversification we generally mean the non-perfect correlation of returns between US stocks and international stocks—in other words, they do not go up and down in perfect lockstep. This is the diversification argument that Dr. Blume was making in 2016 which still holds true. More specifically, even in our interconnected world today, macroeconomic forces that impact individual countries and regions are not perfectly synchronized around the globe, and this contributes to a non-perfect correlation (i.e., diversification benefit) between US and international equity returns.

The other way I like to assess the benefit of an international equity allocation is through “return diversification.” The reason the topic of international investing is still highly debated today is that, if we fast forward nearly a decade from the date that Dr. Blume published his note, his first sentence remains truer than ever. Over the past thirty years through the end of January 2025, US stocks as measured by the Russell 3000 Index generated an annualized total return of 10.85%. International stocks as measured by the MSCI ACWI Ex-USA IMI returned about half of that figure, at 5.40% 1 Data are from Morningstar. This index is the MSCI ACWI (All-Country World Index) Ex-USA IMI (Investable Market Index), which captures large-, mid- and small-cap representation across developed markets countries (excluding the United States) and emerging markets countries. The index covers approximately 99% of the global equity opportunity set outside the US. See: https://www.msci.com/indexes/index/664211 for additional detail.. That is an astoundingly large difference over a 30-year period of time.

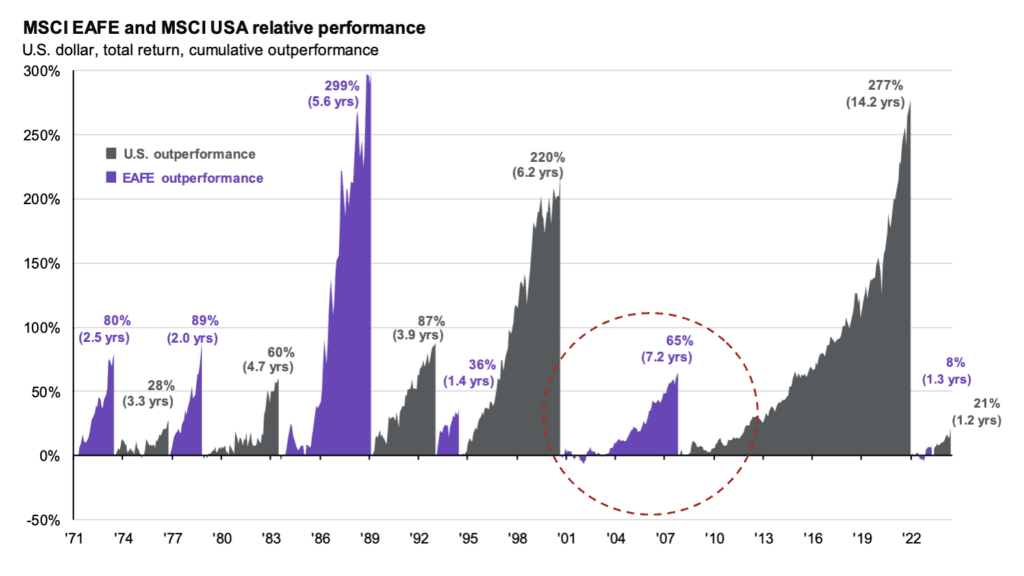

With US equity dominance feeling inevitable of late, it is easy to forget that it has not always been this way. There have been extended stretches of time, the most recent of which occurred in the early 2000s, during which international equities handily outperformed US equities. Refer to the purple-shaded regions in the figure below, which goes even further back through the 1970s. When I write about return diversification, this is the point that I am referring to—as can be seen below, these cycles of out- and under-performance ebb and flow through time and are highly difficult to predict in advance. It remains likely that, at some point in the future, international equities will once again outperform their US-based peers, and we want the portfolios that we build for our clients to participate in such returns.

Notes: The figure above was taken from the J.P. Morgan Guide to the Markets®. 3Q 2024. Sources: FactSet, MSCI, J.P. Morgan Asset Management. Regime change determined when cumulative outperformance peaks and is not reached again in the subsequent 12-month period. Guide to the Markets – U.S. Data are as of June 30, 2024. The MSCI EAFE is an international equity index that covers developed markets countries, excluding the United States and Canada.

Notes: The figure above was taken from the J.P. Morgan Guide to the Markets®. 3Q 2024. Sources: FactSet, MSCI, J.P. Morgan Asset Management. Regime change determined when cumulative outperformance peaks and is not reached again in the subsequent 12-month period. Guide to the Markets – U.S. Data are as of June 30, 2024. The MSCI EAFE is an international equity index that covers developed markets countries, excluding the United States and Canada.

But if US equities have outperformed international equities by such a wide margin over a multi-decade horizon, do these diversification theories provide sufficient justification for why a US-based investor should bother holding anything else? Below are two rationales based on current facts for why PMA’s Investment Committee believes that it is still important to keep our international equity allocation intact.

- From a return-based perspective, if we break out the components of a “total return” into a few key categories including (1) earnings growth, (2) dividend yield, (3) valuation expansion/contraction, and (4) currency return (for international equities), at least two of the four categories favor international equities at present. More specifically, while US corporate earnings may continue growing faster than those of their international peers, international equities offer generally higher dividend yields and trade at far more attractive price multiples. US equities, and in particular mega-cap technology companies (i.e., the “Magnificent Seven”), currently trade at lofty valuations after a stretch of very strong performance. Such high price multiples suggest lower returns in the future, and the US equity market is fairly concentrated, with the top 10 companies in the S&P 500 making up over 37.5% of the Index by weight in early February 2025 2 For additional detail, see: What You Should Do About the Stock Market’s Giant Problem. The Wall Street Journal. Jason Zweig. February 7, 2025. https://www.wsj.com/finance/investing/what-you-should-do-about-the-stock-markets-giant-problem-f4ca338e. .

- From a risk-based perspective, it is true that over the past few decades, globalization has provided US-based investors with some international exposure via large, multi-national corporations. For example, the S&P 500 currently generates a meaningful percentage of its revenue from international sources. In present times, however, the forces of globalization seem to be in retreat (i.e., sprawling international supply chains are being reconfigured and re-shored). The macroeconomic forces that impact individual countries and regions that I referenced earlier project to become increasingly disconnected in the future. Such longer-term trends may further reduce the correlation between international and US equities, strengthening their added diversification benefit to a US-centric portfolio.With all of that said, it is certainly possible that in 2035, PMA will publish another note about international investing, citing the same verbiage from Dr. Blume in 2016. For all of the issues we face here in the United States, there are at least as many challenges facing other countries and regions including: the potential ignition of a global trade war, Europe’s economic malaise, and China’s weak property-market and slowing growth (to name a few).

PMA currently targets an international allocation of 20% of our equity sleeve in most portfolios. This allocation is primarily exposed to developed markets countries like Japan, Canada, and Western European nations. The broad market weight of international equities in the global market-capitalization-weighted universe is closer to 35% at present, so PMA currently maintains roughly a 15% underweight position on a market-relative basis. While we believe that the diversification achieved via an international equity allocation is a component to long-term investment success, the United States has and will remain the most important pillar of the portfolios that we build for our clients.