Why Own More than Just a Handful of Tech Stocks?

Back in 2023, “ChatGPT” captured the imagination of the country with an unbelievable new technology rooted in artificial intelligence. I was skeptical at first but after asking this “chatbot” to answer complex investment questions that involved intuitive reasoning and number-crunching, I, like most of its other users, was extremely impressed by its power and novelty.

The markets shared this exuberance. Share prices of large technology companies with potential exposure to the future of artificial intelligence skyrocketed. An index comprised of ten very large technology stocks, the NYSE FANG+ Index1 The list of stocks currently held in this index includes well-known companies like Meta, Apple, Amazon, Netflix, Microsoft, NVIDIA, etc. For more detail, see: https://www.ice.com/fangplus. , delivered a stunning 96.4% total return in 2023, far outpacing the S&P 500 Index, which itself delivered a very strong 26.3% return. The large technology companies of the NYSE Index obviously also represent a very large component of the S&P 500 Index, and were by and large responsible for its 2023 performance.

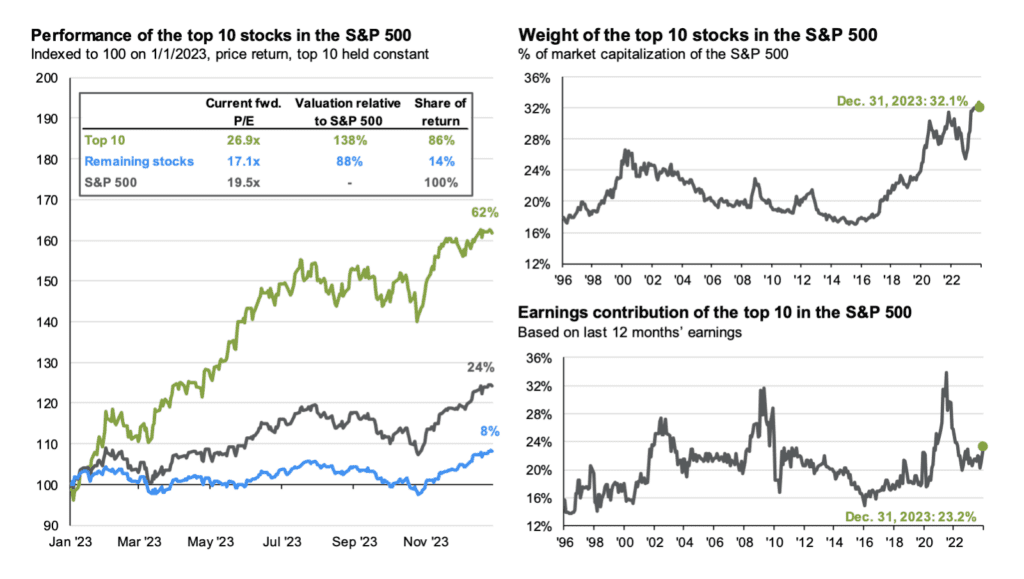

More specifically, the top 10 stocks in the S&P 500 last year were responsible for 86% of the Index’s price return (i.e., capital appreciation excluding dividends), while the remaining roughly 490 stocks contributed a meager 14% of the price return. In industry parlance, this is referred to as a lack of market breadth, as just a small handful of stocks drove a majority of the index’s gains. As a result of the rally in these stocks, they represented just over 32% of the S&P 500 Index as of the end of 2023—a greater concentration level than seen during the dot-com bubble of the early 2000s and well above the index’s recent historical average. Many of these large technology companies also currently trade at high price multiples, making them richly-valued compared to other large US companies in the S&P 500 Index.

Source: J.P. Morgan Guide to the Markets®. 1Q 2024. FactSet, Standard & Poor’s, J.P. Morgan Asset Management. 2 Notes: (Left) The top 10 companies used for this analysis are held constant and represent the S&P 500’s 10 largest index constituents at the start of 2023. The top 10 stocks are: AAPL, MSFT, AMZN, NVDA, GOOGL, BRK.B, GOOG, META, XOM, UNH, and TSLA. The remaining stocks represent the rest of the 494 companies in the S&P 500. (Right) The top 10 companies used for these two analyses are updated monthly and are based on the 10 largest index constituents at the beginning of each month. As of 12/31/2023, the top 10 companies in the index were AAPL (7.0%), MSFT (6.9%), AMZN (3.5%), NVDA (3.0%), GOOGL (2.1%), META (2.0%), GOOG (1.8%), TSLA (1.8%), BRK.B (1.6%), AVGO (1.2%) and JPM (1.2%). Guide to the Markets – U.S. Data are as of December 31, 2023.

Whether or not this degree of concentration is a problem for the US equity market is currently under debate, with varying expert perspectives across the industry ranging from echoes of the last dot-com bubble to it’s generally not an issue. In any event, it’s easy for investors to look at returns from mega-cap technology stocks over the last year and conclude that they are the only companies needed in a portfolio. Firms like Microsoft and Apple have strong business models, healthy finances, and highly capable leadership—a far cry from companies that went bust during the dot-com implosion that were valued based on website clicks. Moreover, many of these firms sit on the leading edge of technological innovation which is likely to play a large role in driving the US economy forward in the future.

We expect that none of our clients will be surprised to find that PMA does not believe concentrating your assets in a handful of stocks (or one industry sector) is a prudent approach. Of course, I am writing about the core investment principle of diversification, and in a broader sense, risk control, an investment tenet at the center of how PMA manages assets. Here are a few specific examples of why this type of highly concentrated investment approach generally fails over the long-term.

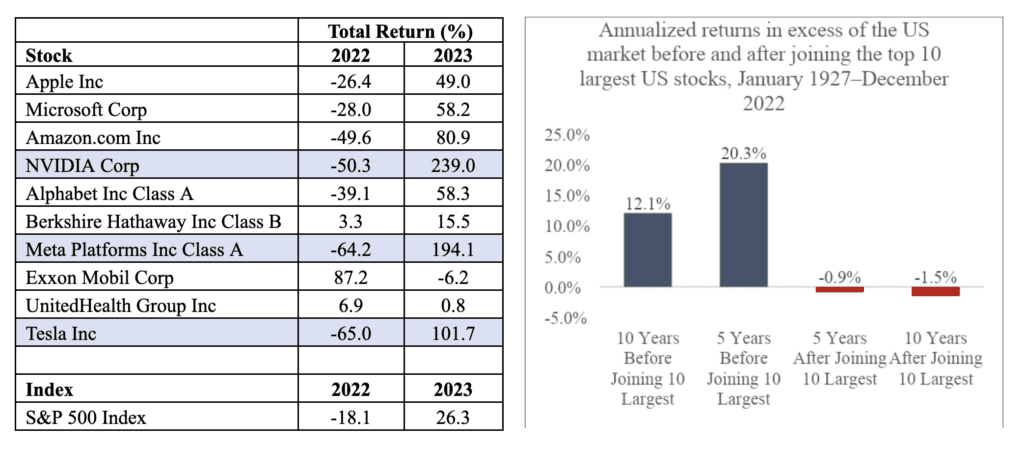

First, these stocks can be highly volatile on a year-to-year basis, which can make just holding on to them feel like a roller-coaster ride. If we rewind just another year back to 2022 when rapidly rising interest rates and high inflation dominated the investment climate, many of these technology stocks took a drubbing. The left-hand table below presents returns for the ten large stocks used in the analysis above for the 2022 and 2023 calendar years. NVIDIA, Meta, and Tesla all lost at least 50% of their value in 2022 and then subsequently experienced over a 100% return in 2023. Quite a wild ride. When we as investment professionals think about the volatility of returns as a measure of risk, this is a perfect (if somewhat extreme) example of what that means.

Notes: Past performance is not indicative of future returns. (Left-hand side) Data are from Morningstar. (Right-hand side) Data are from Dimensional Fund Advisors. 3 In USD. Data from CRSP and Compustat. Companies are sorted every January by beginning-of-month market capitalization to identify first-time entrants into the top 10. The market is defined as the Fama/French Total US Market Research Index. The Fama/French indices represent academic concepts that may be used in portfolio construction and are not available for direct investment or for use as a benchmark. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP. See “Index Description” for a description of the Fama/French index data. Indices are not available for direct investment. The index has been included for comparative purposes only. Refer to: Magnificent 7 Outperformance May Not Continue. Wes Crill. December 7, 2023. Dimensional Fund Advisors.

What ultimately matters though is what the future prospects are for the giant technology stocks that powered the US market last year. Dimensional Fund Advisors (DFA), an academically-oriented firm that PMA respects, studied subsequent returns for large US companies after they become one of the 10 largest stocks in the market. Refer to the right-hand figure above. DFA found that returns leading up to a stock joining the cohort of the 10 largest companies were very strong. However, 10 years after joining this esteemed peer group, DFA found these companies delivered negative excess returns of -1.5% on average relative to the broad US market. In other words, in the years after climbing to the top of the mountain, these stocks fell behind and could not keep pace with the broad market moving forward.

So what does this mean for investors? In a separate though related research note, DFA sums up the conclusion perfectly: “While the types of businesses most prominent in the market vary through time, the fact that a small subset of companies’ stocks account for an outsized portion of the stock market is not new. And it remains impossible to systematically predict which large companies will outperform the stock market and which will underperform it. This underscores the importance of having a broadly diversified equity portfolio that provides exposure to a vast array of companies and sectors.”4 Refer to: Large and In Charge? Giant Firms atop Market is Nothing New. June 17 2020. Dimensional Fund Advisors.

PMA cannot purport to know what the future holds for the handful of giant technology firms that at the moment sit atop the US stock market today. At year-end in 1980, IBM was the largest stock in the US market, though oil companies dominated the top 10 list. In 2000, General Electric was the biggest. In 2010, the title went to Exxon Mobil, and in 2015, it transitioned to Apple.5 Refer to: The Biggest Stocks. A Wealth of Common Sense. Ben Carlson. July 20, 2017. https://awealthofcommonsense.com/2017/07/the-biggest-stocks/. At present, it’s Microsoft. Right now, artificial intelligence is the rage, but in five or ten years, it’s likely to be something different. The beauty of owning a well-diversified portfolio is that, no matter what the future holds, an investor will own whatever companies become the next big thing and participate in the returns that accompany them.