A Note on Market Volatility

Given recent market volatility, and the significant amount of ambiguity in the markets and within American trade policy, we are writing to give PMA’s perspective on recent events.

Although investing always involves a high degree of uncertainty, the uncertainty related to current US trade policy has been unsettling. As a result, the markets have been choppy in the early start to this year. As of the market close on March 13, 2025, the S&P 500 Index experienced a “correction” (a decline of over 10% from its most recent peak in February 2025), while other indices such as the Nasdaq had already reached correction territory.

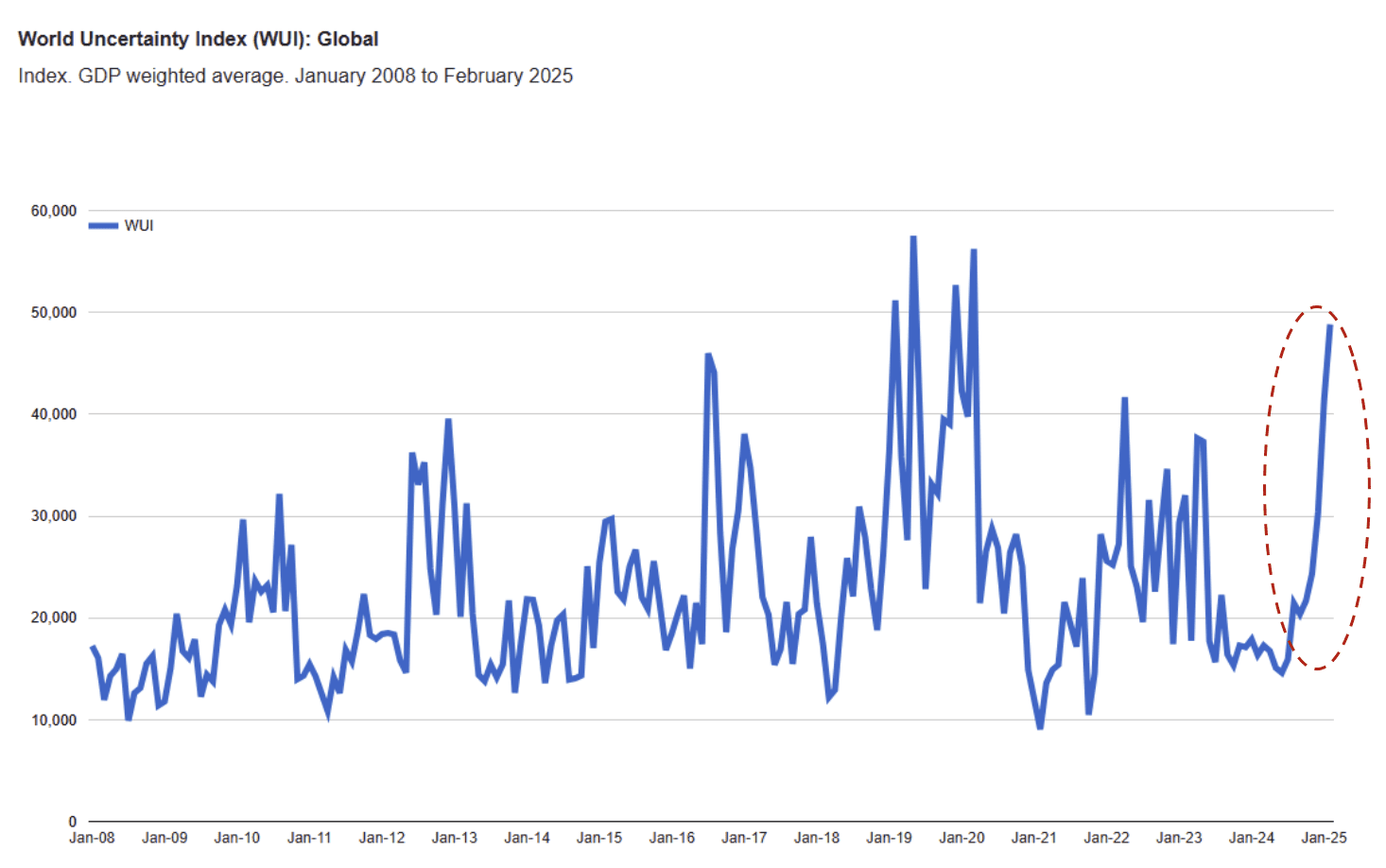

PMA previously published a note titled Investing in an Uncertain World in which we described the World Uncertainty Index1 The World Uncertainty Index is computed by counting the percent of word “uncertain” (or its variant) in the Economist Intelligence Unit country reports. The WUI is then rescaled by multiplying by 1,000,000. A higher number means higher uncertainty and vice versa. For example, an index of 200 corresponds to the word uncertainty accounting for 0.02 percent of all words, which—given the EIU reports are on average about 10,000 words long—means about 2 words per report. See: https://worlduncertaintyindex.com/. as one of many statistical measures designed to quantify “uncertainty” around the globe. The spike seen at the beginning of 2025 from this Index underscores the ratcheting up of uncertainty levels, now approaching levels last seen at the commencement of the pandemic five years ago.

Without question, a significant contributor to this spike in uncertainty levels relates to tariff policy, a topic that PMA addressed in a note to clients in March 2018. As that note described, although tariffs were once widely used by US governments as an instrument of policy, since the 1930s the great majority of economists agree that tariffs should be disfavored —particularly under a scattershot approach where used widely against friends and adversaries. Economists characterize tariffs as a tax levy that should lead to higher prices, disproportionately affecting lower income workers who spend a greater percentage of their income on consumption, and lower growth. While President Trump appears to look fondly on the pre-WWII-era, when a high tariff was made higher in 1890, 1897, 1922 and 1930, it is an unavoidable fact that the world’s global economy is significantly more integrated today than it was 100 years ago.

The extent of the impact of any tariffs the President chooses to implement also depend on a number of variables, including how long they remain in place, the underlying supply/demand dynamics of the industries affected, currency movements, to what extent viable substitutes exist for any tariffed goods, and others. For example, the Wall Street Journal studied the impact of tariffs2 How Much Do Tariffs Raise Prices? The Wall Street Journal. March 2, 2025. See: https://www.wsj.com/economy/trade/how-do-tariffs-affect-prices-trump-plan-009aa14e. using analysis from Moody’s and provides this illuminating example:

Moody’s analysis suggests a 10% tariff on a tablecloth from India would only raise the final price 2%, from $25.99 to $26.51. Tariff pass-through on tablecloths from India is limited because a lot of countries produce tablecloths and compete fiercely for American consumer dollars.

A wide variety of factors beyond US trade policy also affect the markets. While the recent downturn in the US equity markets was seemingly triggered at least in some large part by the recent trade war, US equities were also at the same time trading at rich prices after an extended stretch of strong performance. Risky assets like US stocks that are sitting at high valuation multiples are generally more prone to rapid price swings.

Corrections, drawdowns, and volatility in the equity markets are common, and as with everything in life, framing matters. As alluded to above, the S&P 500 Index (including dividends) rose by 26% in 2023, 25% in 2024, and is down approximately 6% in 2025 through the market close on March 13. In other words, since January 1, 2023, the S&P 500 is up approximately 49%, a significant positive return over a period of two years and two months.

In short, US stocks have been on an astonishing run over the last few years that have contributed to significant growth, even with this recent bout of volatility in mind. Additionally, for well-diversified portfolios, broad international equities have provided a modest offset by delivering a positive return to start the year.

Predicting what is next is unwise given the level of uncertainty and the unpredictable nature of short-term future market events; any analysis that suggests otherwise is taking advantage of the deep human need to be told what will happen in the unknowable future.

PMA’s Investment Committee will continue to monitor market risk related to this trade war and the broader macroeconomic landscape. We may decide to make modest portfolio adjustments in the future as our view of risk in the markets evolves. With that said, many clients have been investing with us long enough to know that our best advice is often to block out short-term noise and focus on the long-term. Our advice today is no different.